- Making it in crypto

- Posts

- Arbitrum season. Part 1 - GMX incentives

Arbitrum season. Part 1 - GMX incentives

Farming opportunities, implications, potential pumps

1. Context

50 Million ARB tokens are about to be distributed through the next 4 months to incentivize the activity and liquidity within Arbitrum.

This will have important implications and generate interesting opportunities, especially taken into account the current state of crypto (dry volumes, low on-chain activity etc)

The main interest of these series of articles is to highlight the incoming opportunities, main implications and how incentives can affect the price action of each token.

Some articles will include several protocols, but in this case will be only focusing on GMX considering will receive 12M ARB tokens, which represents 24% of the total grant. Big implications for both GMX and partner protocols.

2. GMX incentive overview

Preliminary GMX ask was 14M ARB to be distributed in the way the below image shows.

12M to be used directly by the protocol to reduce trading fees and attract further liquidity in GMX v2 pools.

2M would be redirected to partner protocols that are building on top of the new GMX v2 model.

Allocation of ARB rewards

After listening to community feedback, GMX decided to reduce their ask from 14M to 12M ARB.

Still uncertain how the reduced ask will be distributed among sections, so will work under the assumption each section will be reduced by the same amount (15%)

There is not much info about the integration support yet, but probably those tokens will be allocated to projects building on top of GMX v2 pools (delta neutral vaults, funding rates arbitrageurs etc) or even front-end providers.

Focus on this article will be on trader and liquidity incentives impact, as there is more info about that and thus impacts are easier to calculate.

Let’s delve in!

3. Trader incentives

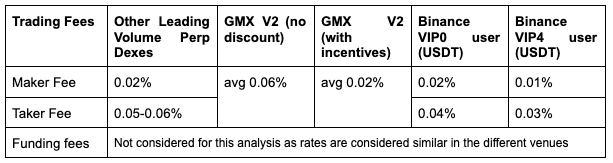

5,14M ARB (6M before the reduction) will be directed to trader incentives, in an attempt to lower fees even more and make them comparable to some the lowest fee tiers of Binance on average.

Initial estimation was to reach a 0.02% of the notional size for each trade, currently the average is 0.06%, being 0.05% trades contributing to balance the Open Interest of the pool and 0.07% otherwise.

Final fees will be determined by the volume that takes place within the period (the bigger the volume, the bigger the fee percentage will need to be on average, as there is more volume to distribute the same rewards)

Anyways, the proposal makes it clear that in any case rebates to traders will not be bigger than fees paid by traders.

Trader incentives rationale

What are the implications/impacts of this move?

The lower the fees, the bigger the volumes right?

Yeah, ceteris paribus rest of conditions (volatility…) this should be true.

The important question though is, by how much does volume increase with the fee reduction?

Not an easy question to answer, as we need to know the price elasticity of demand and obtaining that curve is not an easy feat, mainly due to the high number of variables to compare, making it harder to reach solid conclusions.

In order to make a decent comparison, fair from perfect though, we will formulate some hypothesis and use data from GMX v1 & v2 to extract some rough numbers.

Due to the particularities of leverage trading and GMX, think the Volume/OI is the best metric to use here, as shows how often does the open interest get refreshed, which shows how the trading dynamics change (swingers vs scalpers) with respect to the fee level.

Almost always, the lower the fees, the higher the Volume/OI ratio, and GMX is no exception. GMX v1 has 0.1% on notional size, while GMX v2 has 0.06% and the average of the last 15 days GMX v2 ratio is 2.96. Let’s say 3 for the sake of simplicity.

Volume/OI ratios

Would be fair to assume that the whole change is derived from the fee change?

Probably not, as there are other significant changes between both versions, like price impact & funding fees that encourage farmers to step in and earn some cents on the dollar for balancing pools.

Let’s say just 50% of the increase in Volume/OI is direct consequence of the fee reduction from 0.1% to 0.06%. This way we will be able to calculate how will that ratio change with the new fee reduction, and that way establish a certain Volume/OI given a volatility level.

Approximating the elasticity price demand curve to a straight line (does not make sense to complicate further considering the lack of data & assumptions) and using the previous info we obtain the following equation.

Fees = -0.00012356 * Volume/OI + 0.0018

Solving for the case of 0.02% fees (estimated for v2 with ARB rewards) we obtain Volume/OI = 1.29, which represents a 33% increase from the Volume/OI = 0.97 at 0.06% fees.

All in all, just directly related to the fee reduction GMX v2 will increase it’s volumes by 33% for a certain OI and volatility.

Won’t delve deeper into the matter, but usually Volume/OI ratios increase proportionally to the volatility index and that is why the fee generation capacity of exchanges is higher under volatility conditions in the market.

Currently we find ourselves in the lowest volatility period of the last 4 years.

Would expect it to rise frontrunning the ETF news on January.

Crypto volatility index evolution

Ok, but then how much Open Interest (OI) do you expect GMX v2 to have in the period?

This takes us to the next point, estimated TVL and farming opportunities.

4. Liquidity incentives

The GMX proposal was pretty detailed and they showcased the preliminary ARB rewards for LPs in each of the pools. This might suffer some changes, especially due to the change in the grant size.

Distribution proposal among pools

Here is a new table to adjust for this differences and extract some rough numbers to highlight the best farming opportunities

Updated table with estimate APRs and future TVL

Even though the majority of ARB rewards will be directed to the biggest pools (BTC/ETH) those do not present the best opportunities by itself, as those are in some altcoin pools which currently hold very little TVL compared with the big ones.

As such, some pools like SOL or DOGE are very attractive offering APRs close to 150% at launch, or even some stable pools (to facilitate just swaps) offering up to +360% APR like the USDC-DAI one.

One important caveat, is that APRs will decrease as more capital enter the pool, and as such, APRs from the smaller pools will tend to low double digits pretty fast, so big players will probably just focus on the big ones.

A specially interesting pool is the SOL one, as 92% of the SOL in Arbitrum is already in the GM pool, and as such more SOL will need to be bridged (and those that do it fast might extract some hours/days of very high rewards)

For the sake of clarity, the general picture looks like this considering current TVL and estimated rewards. The flexible distribution section is not included yet.

Estimated initial APRs per pool

How will yields look on average?

That will totally depend on how much new liquidity is deposited in GM pools, my hypothesis is most pools could settle around 10% APR in ARB rewards plus the organic reward those pools are already generating (around 10% on average)

Under these assumptions, we reach a potential $117,25M in TVL distributed among GM pools as the below image shows.

Potential TVL

Currently TVL in v2 sits at $45M, so this would would be a 2,6x multiplier and would allow around $100M in Open Interest, which is already very significant considering how the perp dex landscape looks like at the moment.

Open Interest by protocol

5. Conclusions

I expect this incentive program to have a very positive effect on GMX v2 adoption:

2,6x TVL of the GM pools from $45M to $117M

Open Interest to scale in the same proportion, establishing for a while around $100M

+20% APR yields to liquidity providers (half organic + half in ARB rewards)

+33% increase in Volume/OI for a given level of volatility

So aggregating all the conclusions, I think it’s fair to expect GMX v2 to facilitate around $90M daily volume on average by Jan 2024 at this same level of volatility.

We reach this estimation if we multiply current daily volume ($25M) by the estimate increase in OI and Volume/OI (2,6 × 1,33 = 3,46)

Would also expect volatility to rise at to the 60-80 CVOL levels, meaning this at least a 50% rise from current levels.

I expect the increase in Volume/OI to be proportional to the increase of volatility, so that would put the end figure around $150M daily volume if I am not wrong about the evolution of volatility.

What about the price of $GMX?

I expect it to be correlated to the fee generation of the protocol, so if the protocol does well, numba will probably go up.

DYOR and make your own informed decisions though, this is crypto and anything can happen.

Hope you liked the article and see you tomorrow in the next one.

Stay safe